Despite the current period of reduced strength, the Indonesian stock exchange has demonstrated resilience in the face of global factors, such as the rebound in interest rates in the West. This is a common phenomenon in many emerging markets and, in our view, presents a unique opportunity to incorporate this promising market into our balanced portfolio.

The Fed is hurting

Like many other emerging countries, Indonesia is currently experiencing a difficult period, which is weighing on the Jakarta stock exchange's performance. Since the beginning of the year, its gains have been limited (+5% in €), below that of the world index.

The combination of high interest rates in the United States and the strong US dollar is a significant factor that does not favour emerging economies. These economies typically have substantial capital needs to finance their required investments. Understanding this dynamic is crucial for potential investors and financial analysts to make informed decisions.

Poor in savings (for most of them, at least), they must therefore attract foreign capital. However, to decide the interest on such an investment, investors first look at the “risk-free” rate (that of U.S. debt) to which they add a risk premium to compensate for the risks incurred.

Indonesia's governance, a crucial factor for potential investors, has significantly reduced the risk premium. Thanks to a decade of stability and credible monetary, fiscal, and fiscal policies, Indonesia has limited the risk premium investors demand to invest in it. At the beginning of 2024, its 10-year debt was trading at around 6.7%, a level lower than that of many other emerging countries, providing a secure investment environment.

On the other hand, the Indonesian authorities cannot do much when the «risk-free» interest rate (that of the United States) increases, as is currently the case (because the Fed does not seem to be in a hurry to lower its key rates). As soon as US rates rise, the emerging world is impacted. This is why the Indonesian 10-year rate rebounded to 7.3%.

The dollar king weighs

The rise in interest rates is all the more dangerous for Indonesia as it is accompanied by another trend: the weakening of the currency. When the United States offers high returns, it attracts most of the world’s savings. Some emerging currencies are, therefore, seeing investors rush out, which weakens their currency.

Since the beginning of the year, the Indonesian rupiah has lost 5% of its value against the US dollar. The weakening of the currency raises the price of imported products and threatens to revive inflation, which has been contained at around 2.5%- 3.0% since the beginning of the year.

Therefore, the Central Bank of Indonesia has raised its key rates by 0.25% to 6.25% to signal that it remains attentive and intends to remain credible in its monetary policy.

Investors received this decision well; it seemed enough to stabilise exchange rates.

A promising future

Beyond the issues raised by the delicate global context, Indonesia retains essential assets. The first is political stability and the fact that the new President Subianto intends to keep the country on track for a decade by his predecessor, the very popular Jokowi.

The latter has revived investment and transformed the country. Once a simple producer of raw materials (including minerals) with low added value, Indonesia has banned nickel and bauxite exports.

The country is the world’s largest nickel producer, a metal essential to the energy transition. Since the export ban, those who wish access to these crucial raw materials have been asked to install production units in the country. This decision has borne fruit. First, Indonesia is absorbing a growing part of the value chain. Then, investors from all over the world, especially from Asia, rush to invest in the archipelago.

Supported by investment and its emerging middle class, the country is on track to achieve growth of around 5% this year until 2026. However, President-elect Subianto intends to go much further and set a goal of developing around 8% towards the end of his term. This would make Indonesia one of the most dynamic economies on the planet.

To achieve this, it intends to use the country’s resources to reduce its energy dependence, including the increased use of biofuels. It also wants to improve access to the internet to digitise the economy. Finally, it intends to improve the skill level of the workforce to improve the country’s competitiveness.

These are ambitious measures, of course, but they seem to be within reach, particularly with the collaboration of Singapore, China, Japan and South Korea, all of which are among the largest investors in the country. Indonesia should, therefore, have good days ahead.

Stable in economic and political terms and enjoying good governance for a good decade, Indonesia is emerging as one of the most promising economies on the planet. However, unlike many other emerging markets (including India), its stock exchange is not expensive and is particularly generous in dividends.

At this stage, the small gap in the Indonesian rupiah and the fact that the Jakarta stock exchange has progressed less than others open an exciting window of opportunity to afford exposure to this country.

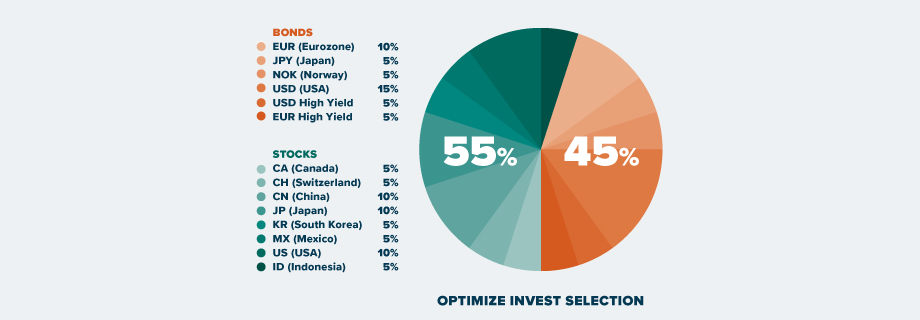

We now invest 5% of our balanced and dynamic portfolios in this market.