Since his return to power on January 1, 2023, Brazilian President Lula da Silva has not sought to reassure investors. However, beyond the speeches, it is clear that the Brazilian authorities are doing a good job stabilizing the Brazilian economy and reforming the process that lays the foundations for a more dynamic Brazil.

An honourable performance, despite Lula

Lula da Silva’s first two terms as President of Brazil, between the beginning of 2003 and the end of 2010, were accompanied by the opening and modernisation of the Brazilian economy, with the result that the São Paulo stock exchange took off. His return to power in 2023 was less well received. His speech is now more interventionist, especially about the control of state enterprises. It is also less concerned about balancing public finances. This is a position of distrust towards economic orthodoxy and investors that could have hurt Brazilian financial assets and its real currency.

Fortunately, the Brazilian economy has shown remarkable resilience. Since Lula’s return to power, the Brazilian real has appreciated slightly against the euro. At the same time, the stock exchange of São Paulo has taken about 20% (in €), a performance down against the best, of course, but honourable in absolute terms. At the same time, Brazilian bonds, long present in our portfolios but difficult to access for most European investors, have done even better, taking 24% over the same period.

Observe what Brasilia does, not what it says

Several factors explain Brazil's excellent asset performance, including the country's well-underway reform process.

The introduction of VAT, which replaces a myriad of consumption taxes, is one of the flagship measures of a tax reform that aims to simplify taxes and increase tax revenue. It also has the potential to revive economic activity.

These elements have notably enabled the rating agency S&P to increase the rating of Brazilian debt at the end of 2023. When Moody’s looked at it in the early spring, it also noted the progress towards gradually bringing public debt to sustainable levels while laying the foundations for better growth. The outlook for the Brazilian rating has been revised upwards, becoming positive rather than neutral.

The verdict is clear: If Lula is not the most conventional leader, it is to ensure stability. We are, therefore, far from the image of the President willing to spend without counting what the latter seems to cultivate.

A central bank still credible

While fiscal and fiscal policy is on the right track, monetary policy continues to reassure, with the Brazilian Central Bank doing what it can to establish its credibility. For a long time, it was the most credible institution in the country, not hesitating to push its Selic policy rate up to 13.75% to fight inflation and prevent it from taking root.

Since Lula came to power, the monetary policy committee members he appointed have been more interested in supporting growth than fighting inflation. They aim to make monetary policy more expansionary (by lowering policy rates as quickly as possible) to revive economic activity. The Central Bank thus took advantage of less pressing inflation (at 3.9% in March against peaks around 12% in Spring 2022) to agree to six declines in the Selic since the beginning of 2023.

But it did not jeopardise its reputation. Brazilian rates that fall too quickly would erode the differential between them and US rates and risk causing a rush to exit investors, weakening the real on the foreign exchange markets. This would jeopardise the stability that the Central Bank has been fighting for a long time. Therefore, the Selic is still at 10.75%. And when the Fed was less enthusiastic about lowering rates in 2024, the Brazilian authorities quickly spread the message: Brazilian rates will also fall less than expected in 2024. Investors are now expecting them closer to 10% than 9% at the end of the year.

At this level, Brazilian bond yields remain high in absolute terms and largely positive in real terms (i.e., higher than inflation). This supports the real and further strengthens the credibility of the Brazilian central bank.

However, this still costly credit will weigh on economic activity in Brazil, with growth expected to remain below 2.0% in 2024 before reaching it in 2025.

The first 17 months of Lula’s new presidency have been difficult for investors. Nevertheless, the current government seems determined to ensure the economic and financial stability that the country needs to realise its potential.

If growth is not about to explode, its Brazilian prospects are attractive, as are those of the São Paulo stock exchange. The financial sector (26% of MSCI Brazil), energy (24%), and commodities (17%) account for about 2/3 of this market and is generous in dividends (6.9% for the end of April). It offers a valuation level below many others (price/profit ratio of 8.27).

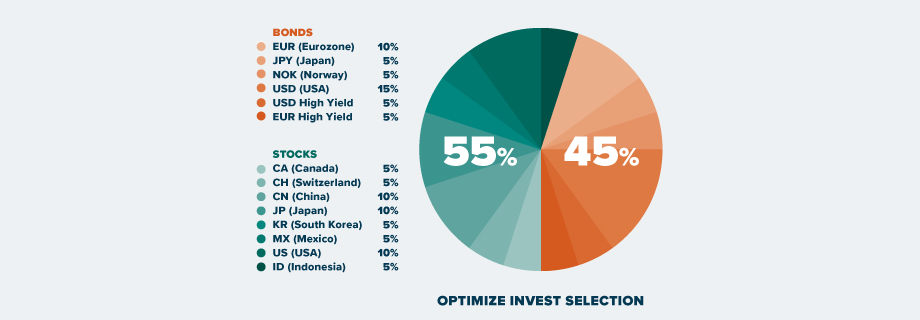

Unfortunately, it is not without weakness: faced with the country’s high debt, it suffers when the price of credit rises. At the same time, its exporters (including Vale) are suffering from a slowdown in global demand. Therefore, the Brazilian stock exchange is highly volatile and will be interesting, especially to investors with limited risk aversion. Nevertheless, for the latter, it constitutes an exciting diversification. We now invest 5% of our dynamic portfolio.