Still lacking dynamic domestic demand, and heavily focused on investment and exports, China is still in the hot seat. The United States has announced new tariffs on some Chinese products, and Europe is considering following suit. This is bad news for the Chinese economy. Yet, at the same time, the Chinese stock market has given itself some air. With a 15% increase since the beginning of the year (prices and dividends, in €), it is, at this stage, the best performance of the year among the major markets. How do you explain it?

Domestic demand: China’s weak spot

This is not new: the Chinese economy is highly dependent on investment (more 40% of GDP) while the share of household spending in the economy is relatively small (39% of GDP in 2023). The Chinese consumer is making the most of savings, which for several years has exceeded 45% of GDP. If one does so, it is because the consumer knows that must cope, alone or almost, in the event of illness or unemployment and that he or she must have what it needs when gets to an old age.

This fundamental trend, which has been going on for decades, has been further reinforced by two recent phenomena, which have highlighted the importance of savings: there have been concerns about the real estate market and the fall in prices of the latter, which has impacted household wealth (and therefore their stockings and their confidence for the future). Then there was the pandemic and the fact that, contrary to what happened in the West, where states put their hands in their pockets to help households and businesses, in China the latter were forced to cope on their own. This promotes savings and weighs on consumption.

Growth through investment reveals its limits

At the same time, Beijing is committed to its growth goals. And to achieve that, it invests. However, by creating new production capacity while demand remains weak, the country is left with significant overcapacity. Very low inflation (0.3% in April) or even deflation (fall in consumer prices) to which the country regularly makes in recent quarters, is a consequence of this dynamic. To try to reduce the pressure on prices and allow its companies to survive, China is looking for markets elsewhere. So export pressure is important. It used to be pretty good. But after decades of strong growth, China has become a heavyweight in the global economy and its trading partners are struggling to digest the surge of Chinese products, especially in sectors that the country dominates without sharing.

Protectionism will be expensive

This explains the rise of shields against Made in China and why the country is so criticized by politicians in search of popularity in Washington or Brussels. However, we must face the facts: in certain areas - especially the energy transition - the world cannot do without China and will have a hard time remaining competitive with its cheap and very innovative production. For decades, while others were discussing this transition, China was taking action, investing heavily to dominate the value chain associated with these products. Solar, wind, battery, electric vehicles are all sectors where Chinese producers have a head start and the fall in prices caused by Chinese production encourages the adoption of these technologies, in China as elsewhere.

For now, the country exports about 16% of the electric vehicles it produces and few of them go to the United States. The impact of Washington’s 100% tariffs will therefore be limited. But let’s face it: increased tariffs on batteries, solar cells, semiconductors, and other rare earths will reduce competition, and make products incorporating these technologies more expensive, This risk slowing down the much desired energy transition in the West.

The awakening of the Chinese stock exchange

Faced with difficulties in achieving its growth objectives and the very low valuation level of Chinese equity markets, Beijing regularly announces new initiatives to revive the economy and stock markets by all means.

There have been fiscal and budgetary stimuli of all kinds, whose impact seems limited. There was also the reduction of the reserve rate of the country’s banks, in order to release more liquidity, stimulating credit. Further reductions in this ratio are likely, and the Chinese Central Bank has other valuable levers at its disposal, such as its key interest rates, still at 3.45% since August 2023, which could well be revised downward.

Other measures have also emerged

For the past few months, the Chinese sovereign wealth fund has been buying shares in the country, which has helped to boost the market, which is much cheaper than other emerging markets. This is all the more the case since China is closely interested in the governance changes that have taken place in Japan - favouring the rebound of the Tokyo stock exchange - and may well be inspired by them.

In addition, there are other initiatives such as the purchase by regional governments of abandoned real estate projects under construction, in order to carry out the necessary work for finishing and their resale thereafter. There are also supports for households wishing to buy a new apartment, including the purchase of their old property, which is then used for social housing. All these measures aim to stabilize a crucial market for China.

The country has also just started issuing state debt at 20, 30 and 50 years, linked to a program that will weigh some 1,000 billion yuan (about €128 billion) and whose objective is to support mega projects in strategic sectors.

So the stimulus is real

While the magnitude of the challenge facing China should not be underestimated, the country’s ability to overcome it should not be underestimated.

The Chinese stock exchange is still a good deal. Despite its good performance since the beginning of the year (gain of 15% price and dividends, in €), it trades at valuation levels well below the world stock exchange and also in net decline compared to those of other popular markets of the moment, such as India. In addition, this market includes a number of leading companies in their respective sectors, which have a very important dimension in their local and regional market, which then allows them to better export elsewhere.

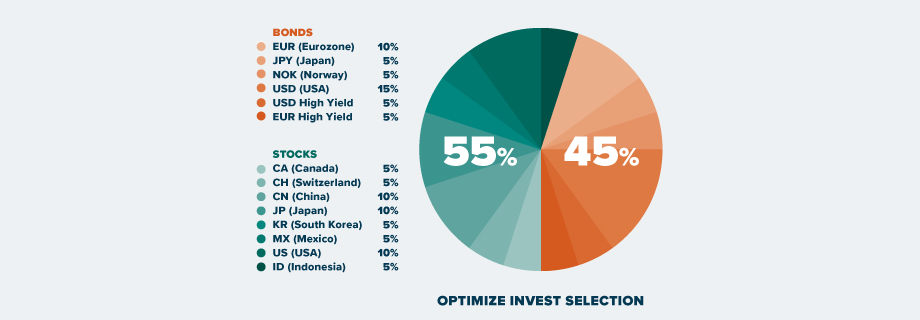

So the future of China remains bright for us. We continue to invest in China across our portfolios.