Having claimed victory at the end of negotiations with most of the United States' trading partners, Donald Trump had to settle for a draw and a 12-month truce in talks with China. This speaks volumes about the rise of this country, which has enough assets to stand up to Washington. Investors would be well advised to take note and include exposure to China in their diversified portfolios.

Self-sufficiency: the watchword for Beijing

Investors were expecting a trade agreement between the United States and China, but what they got was a 12-month truce, during which most tariffs were suspended. This temporary truce will mainly allow the two superpowers to sharpen their weapons, with each trying to reduce its dependence on the other.

For China, the priorities are clear. First, it will continue to advance as far as possible in its technological self-sufficiency. Years of restrictions on exports of semiconductors and other advanced technologies to the Middle Kingdom have forced it to seek viable alternatives at home.

As a result, the billions previously lent to the country's property developers were instead invested in the research and development of new products and technologies.

This strategy is supported by Beijing, which, in its latest five-year plan (outlining the economy), has emphasised science and innovation. Technological power and its integration into industry are priorities.

The goal is twofold: first, to make the economy less dependent on foreign components and expertise, thereby reducing its susceptibility to external shocks.

But above all, China intends to become a leader in these sectors of the future and catch up in others. It is winning this bet in many of these areas.

Only domestic growth is not enough

Another area of development is diversifying suppliers and export markets. In an ideal world, China would like to develop its domestic market. Household consumption and private investment should provide the bulk of economic momentum.

This is not the case. Despite the existing stimuli, the domestic market is growing modestly, and households are still rebuilding their savings, which were depleted during the pandemic and further undermined by falling property prices.

On the investment front, the outlook is hardly more encouraging: faced with sluggish domestic demand and concerns about foreign trade, companies are reluctant to invest, to the point that investment declined in the third quarter for the first time since the pandemic and 2020 lockdowns.

Higher dependency on foreign trade

In this regard, the 12-month truce agreed with the United States is disappointing, as it does not provide businesses with sufficient visibility to plan for the medium- and long-term. Businesses will therefore continue to wait and see, and investment, which is currently sluggish, is likely to remain so.

China, therefore, remains heavily dependent on foreign trade for its growth. Knowing that exports to the United States will continue to be closely monitored by Washington, it is attempting to diversify its export markets as much as possible.

This policy is bearing fruit: exports to the rest of the world (particularly emerging markets) have grown strongly in recent quarters, helping limit the damage from US tariffs.

The 5% target is still within reach

Despite being embroiled in trade turmoil for much of the year, China will still achieve its 5% growth target for the current year.

The strong start to the year has played a significant role in this. By building up large stocks of Chinese products before the tariffs came into force, US buyers gave Chinese exporters an excellent start to the year.

Since then, growth has slowed somewhat, barely exceeding 4.8% in the third quarter, mainly due to a decline in investment.

However, exports have remained buoyant, thanks to the rest of the world's appetite for Chinese products. This economic performance, which is close to Beijing's targets, allows the authorities to wait before intervening to support the economy.

Caution with stimulus

There is little doubt that new stimulus measures will be introduced. However, the scope for new fiscal or budgetary measures is more limited than in the past. Over the last four years, the budget deficit has averaged 6.5% of GDP. As a result, China's public debt has risen sharply, from 70% of GDP in 2021 to 88% in 2024.

There is greater room for manoeuvre on the monetary policy side. China's main policy rate remains at 3.0%, and only one cut (0.1%) has been announced in 2025. If necessary, the central bank could go much further.

Since early 2025, the country has often been in deflation. At the same time, the authorities would like to stimulate household spending rather than savings. However, very cheap credit could well trigger a surge in consumption in a country where household debt represents only 60% of GDP, which is lower than in most G7 countries.

Performance superior to Europe and the US

While the outcome of negotiations with the United States does not offer Chinese companies the visibility they would like to invest in the immediate term, there is little doubt that Beijing will use the 12-month truce to consolidate its dominance in many sectors and catch up in others.

Investors are satisfied with this and are taking note of China's entry into the big leagues, with a return to Chinese markets. With gains of more than 30% over one year, they are outperforming the European and US markets.

A giant difficult to ignore

Even if Beijing's role in the economy worries some, and the Chinese stock market is undoubtedly more volatile than Europe's or the United States', such a performance for a player of this size and so competitive in so many sectors is difficult to ignore.

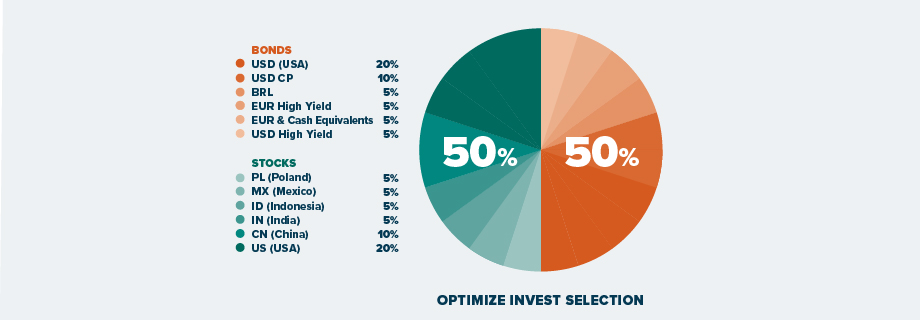

At the same time, this market still offers valuation levels well below the global index. The price-to-earnings ratio for the next 12 months is around 13 for MSCI China, compared with over 20 for MSCI World. We therefore believe that increased exposure to this market is attractive. Chinese investment is represented across our portfolio. See our asset allocation strategy below: