To what extent can we realise some growth in the Eurozone with the reduction in interest rates?

Pedro Lino: Growth in the Eurozone has stagnated, especially compared to the US. In the first quarter of 2024, the Eurozone's GDP grew by just 0.5 per cent compared to 1.6 per cent in the US. Germany is still in recession, with GDP down 0.2 per cent, and Italy is still stagnating. Inflation in the Eurozone has been very controlled due to weak economic growth, primarily because of domestic demand. In this sense, for the first time, the ECB has gone ahead of the FED and will cut interest rates by 0.25% in June, signaling that the reversal of interest rates has begun. This won't be enough to guarantee the start of the economy, which depends on exports and internal dynamism, and the rise in prices and interest rates has dramatically damaged it over the last two years.

In what ways could European companies and investors be impacted by a possible increase in the exchange rate differential between the Euro and the Dollar if the US interest rate remains the same or rises while the European interest rate falls?

Pedro Lino: By cutting interest rates, the ECB is signaling access to cheaper finance, even if it's for a small amount. Above all, it's signaling to companies that will need to refinance their debt that the maximum interest rate has been reached. The Euro may even benefit, despite the interest rate differential being more favorable to the Dollar, because American and European companies may prefer to issue in Euros than is American dollars since the cost of financing will be lower, for the foreseeing period. Investors are already faced with lower interest rates on term deposits and with zero interest on their demand deposits, meaning that they are going to have their lives made more difficult. Therefore, they should start looking for alternatives for their savings over the next three to five years, period where interest rates are expected to be lower than they are now.

Can investors in Optimize Invest Selection, which is advised by Euroconsumers Invest, benefit, be penalised or do they need to worry about this movement in the markets?

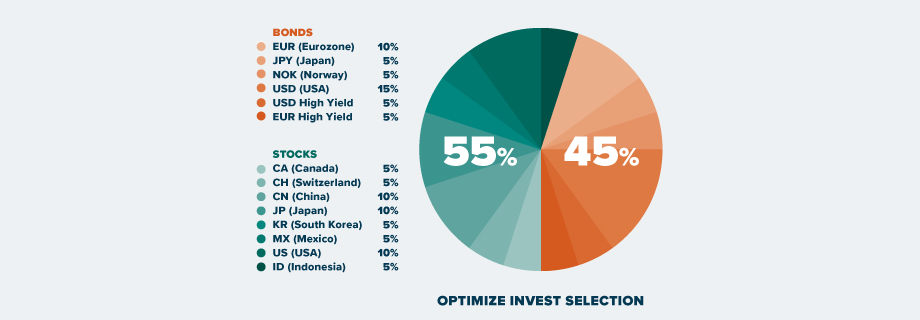

Pedro Lino: In this scenario of lower interest rates, the Optimize Invest Selection Fund presents itself as an excellent alternative for making the most of savings. With the reduction in interest rates, investors tend to gain from two components: the price of bonds tends to rise, and the interest rate are now much higher than it was two years ago, meaning higher coupons or yields in the vast majority of the issuances. The base is 4% in the Euro Zone and 5.25% in the USA, when compared with zero or negative interest rates just two years ago. The fund, which is approximately 45 per cent invested in bonds, is very diversified by geographical area, and will benefit from a new cycle of interest rate cuts that will also reach the US at the end of the year. The stock market will also be supported as the interest rate cut aims to keep the economy growing and avoid a recession. In this sense, the other 55 per cent of the fund is allocated to investment funds with exposure to shares in various geographical areas (see below the current "target" areas).

More information about the Sicav here.

We at ECI expect to see an appreciation in both assets, shares, and bonds, which will boost the expectation of appreciation for the Optimize Invest Selection Fund.

And we're sure to reinforce the advice. "The best way to build up wealth is to invest regularly", advises Pedro Lino. "Try to invest an amount every month without trying to know whether the market is going up or down, depending on your investor profile. In the long term, there's no doubt that you'll be rewarded."