Under normal conditions, elections with large majorities are good news for investors as they signal long periods of stability and visibility on the policies that will be adopted.

However, in Mexico, the markets did not appreciate the result of the general election and feared that the vast left majority, obtained by President Claudia Sheinbaum, would still allow her to review the constitution and impact the reform process. Is this a risk or an opportunity? We believe that the second option is the most plausible and continue to invest in this country.

Mexico is doing rather well

While the economy is not easy, marked by high interest rates (the Mexican policy rate is 11%), it aligns with 10 quarters of moderate growth. At the same time, unemployment is at an all-time low and consumers are confident.

Investment is growing at a good pace. The country’s membership in the Canada-United States-Mexico Agreement (USMCA) gives it easy access to the rich American market and makes it a destination of choice for American companies, wishing to shorten production lines long dependent on China, for companies in the rest of the world that are looking to expand into the U.S. market. In 2023, Mexico became the leading supplier of goods to the United States, surpassing China. It therefore has important assets and could well be promised at a time of strong growth, as credit becomes cheaper.

Public Accounts: A Major Challenge

To take full advantage of this favourable situation, it should ideally benefit from good governance. Since 2018, investors have been struggling to cope with President Lopez Obrador and his particular mix of socialism and nationalism.

While it closed entire sectors of the economy to foreign investment (energy, electricity, ports and airports), it maintained the independence of the Mexican Central Bank and managed to preserve the country’s sovereign debt rating. To do this, it has kept under control the public accounts deficits (4% on average between 2020 and 2023) until the last quarters of his term! During this period, expenses and election promises followed one another. These include infrastructure projects that cost money in the short term, such as the tourist train linking many tourist sites in the south of the country, or the construction of new refining capacity for the oil industry.

Other campaign promises will increase state spending for a long time, such as the increase in pensions and social transfers. Race results: the deficit will approach 6% of GDP in 2024. Ms. Sheinbaum will therefore inherit a very degraded situation on this front and will have to make difficult choices, either by reversing certain social transfers, which would be very unpopular, or by increasing the tax burden, which will not be obvious.

Pemex, the solution becomes a problem

In the past, Mexico has always been able to count on the money of Pemex, the state oil company, to balance its books. It is by appropriating the benefits of Mexican oil that successive governments have made up for the shortcomings in terms of fiscal policy. But now, by dint of drawing from the source, it has been exhausted. Pemex is the most indebted energy company in the world with over USD 100 billion in debt. Investors are reluctant to finance it or do so only in exchange for very high returns. It is therefore the Mexican state that is asked to put its hand in the pocket to keep it afloat. In a restructuring of Pemex’s debt, the amounts needed to keep it afloat will long weigh on Mexican finances.

The fact that President Lopez Obrador chose to protect the foreign investor sector does not help. Pemex lacks the means to invest in its production, which is on a downward trajectory. In April, production fell below 1.5 million barrels per day for the first time in four decades.

Goal: Take full advantage of USMCA

Controlling the public accounts will be a major challenge for the new government. But his main priority will be not to waste the unique opportunity that presents itself to him, thanks to the American will to do without China and produce closer to home. To do so, Mexico will need to improve the business climate, reducing corruption and bureaucracy, to create a more welcoming environment for investors. Sheinbaum wants to stimulate private investment and plans to open a hundred industrial parks since most of the existing ones are full.

But to do so, it will have to develop the electricity grid, which cannot cope with ever-increasing consumption.

The country will also have to improve water supply, which is also necessary for industry, even though a large part of the country is already in a situation of shortage. Finally, there is a need to improve security in the country, as several Mexican cities are among the most dangerous in the world. It should also be borne in mind that the USMCA signatories are expected to provide an update in 2026.

To attract foreign investors, it will therefore be necessary to give prospects of stability in relations with the United States. But the biggest challenge could come from the government itself. The constitutional reforms sought by the outgoing President include a more important role for the State in the electricity sector, as well as the management of fundamental infrastructure such as ports and airports by security forces. To this would be added the direct election of judges of the country (and especially those of the Supreme Court, long opposed to the plans of the President). This does not reassure the markets, which would like to see these essential sectors managed professionally and which explains the air gap experienced by the Mexican stock exchange the day after the election.

In the average of emerging countries in terms of price, the Mexican stock exchange remains relatively affordable given the potential we recognize.

Its proximity to the United States and membership in USMCA offer it a valuable competitive advantage, especially at a time when nearshoring (the approximation of production capacities of the place of consumption) is in full swing, driven as much by the supply chain difficulties exposed by the pandemic, as by the tense relations between the United States and China.

Despite governance not always up to the task since 2018, the country has benefited from this phenomenon. An improvement in the business climate that would take into account the fears and wishes of companies wishing to settle in the country would allow it to take off.

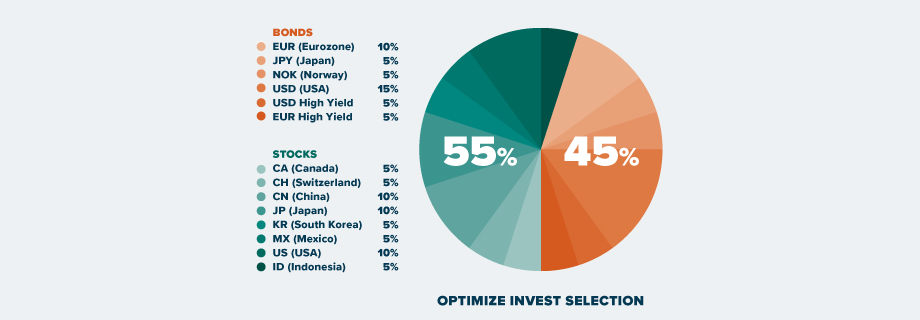

For our part, we believe in it and remain invested in Mexico as part of our neutral and dynamic portfolios.