In a world marked by geopolitical uncertainty, fiscal pressures, and economic upheaval, few countries can combine growth, resilience, and a vibrant domestic market.

Poland is one of these rare cases and remains present in our portfolios, even if the political instability of recent months weighs on this market.

A rare boost in Europe

Poland is currently one of the most dynamic economies in the European Union. With growth projected to be just over 3.0% in both 2025 and 2026, it outperforms major European economies, including Germany, France and the United Kingdom.

Since 2016, its GDP has almost doubled in nominal terms, a performance that leaves its European partners dreaming. This is not a coincidence. This is the result of a coherent economic policy, successful integration into the European single market, and an ability to turn challenges into opportunities. Poland is today the symbol of a Europe that is moving forward.

A sign of this success: the phenomenon of "reverse brain-drain", or the return to the country of talents who had abandoned it in the past.

Following the United Kingdom's exit from the European Union, many Poles have returned to the country. A phenomenon that has continued since, spreading to Poles living in other countries.

They returned to Poland more qualified, richer, and more committed to the development of their country. They fuel consumption, stimulate innovation and investment, and strengthen the local economic fabric.

Such movement is a strong signal: Poland is not only a country where people invest, but it is also a country where they return to build a future.

This leads to a dynamism of the internal market, which is a significant asset for the economy. At a certain point, trade relations at the global level become fragile, protectionism gains ground, and visibility for future trade is reduced. The fact that Poland has a solid domestic market is one of its strengths.

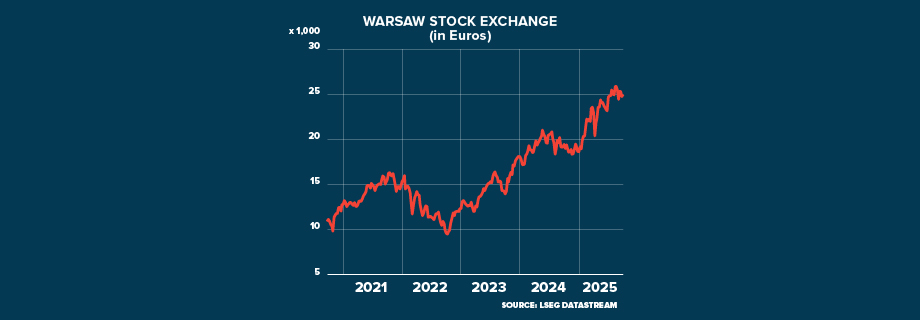

This consistency contributes to the success of the Polish stock market in 2025. Since the beginning of the year, it has posted a gain of 34% (including prices and dividends, in euros).

A highly polarised political country

Unfortunately, the bulk of the Warsaw Stock Exchange's performance was achieved in the first half of the year, and since then, the market has remained essentially unchanged.

The reason for this is the presidential election in June, which left the country deeply divided. Polarisation between President Nawrocki and the Tusk government is creating institutional paralysis. Bills are blocked, policies are contradictory, and governance becomes unpredictable. This political instability acts as a brake on investment, particularly for foreign investors seeking a stable regulatory framework.

The consequences of this uncertainty on the country's budgetary balance are becoming clearer.

Traditionally, Poland has had a relatively healthy financial situation, with a public debt of around 55% of GDP. However, this year, the budget deficit is likely to approach 7%, prompting rating agencies Fitch and Moody's to revise the outlook on Poland's debt rating downwards.

The immediate cause of this concern is that the consolidation of public finances desired by Prime Minister Donald Tusk requires an increase in revenue, resulting from a higher tax burden.

However, President Nawrocki does not see it that way. He rules out heavier taxation and would instead like to reduce it, to boost the birth rate, which, at 1.1 children per woman in 2024, is among the lowest in Europe. This leaves investors in uncertainty and prompts rating agencies to reassess their position.

For the time being, the zloty and Polish bonds have held up well, with the Polish 10-year yield stabilised at around 5.5%. However, this fiscal situation weakens investor confidence and could lead to higher borrowing costs, posing a risk to growth. However, this is a moderate risk, insofar as 3/4 of the Polish public debt is relaxed by the Poles themselves.

A stock market dominated by finance

After a strong start to the year, driven by the influx of European funds, growing spending on NATO's eastern flank - of which Poland is the main pillar - and hopes for peace in Ukraine, investors are hesitating.

However, in our view, the Warsaw Stock Exchange still holds essential assets. Offering a dividend yield of nearly 5% for the MSCI Poland, it is particularly generous in this regard. In addition, its price-to-earnings ratio is around 12x, compared to almost 24x for the MSCI World and 15x for the MSCI Emerging Markets.

The fact that the financial sector represents almost half of this market (49.5%) will likely raise doubts among more than one investor. However, Polish banks are well-capitalised and profitable, offering direct exposure to domestic growth, which is a significant asset in such a dynamic market.

It should also be noted that the profile of the stock market is changing, as is that of the Polish companies. Driven by strong household demand, the retail sector is witnessing the emergence of local players, some of whom are now among the country's largest market capitalisations.

The same applies to the technology sector, which is also booming, driven in particular by the return of talent to the country and the desire to develop centres of expertise. All of these elements continue to make Warsaw a promising market in our eyes.

Political divisions don't compromise potential

Poland has significant room for manoeuvre, and its government, despite the tensions, remains committed to a growth trajectory. Economic fundamentals are strong, and institutional investors continue to have confidence in the country.

Of course, the difficult period of cohabitation in Warsaw darkens this picture. Nevertheless, the country continues to offer interesting prospects and a dynamism that is unique in Europe. It therefore remains interesting to us and is present in all our portfolios as a means of diversification.

The Warsaw Stock Exchange

After an excellent start to the year, the Warsaw stock exchange is hesitating. Nevertheless, it retains some significant strengths and continues to incorporate all our portfolios.