As expected, the US Federal Reserve has lowered its key interest rates by 0.25%. Will this be enough to support the economy and financial markets in 2026?

Although the US Federal Reserve has lowered its key interest rates to 3.5%-3.75%, the downward cycle is gradually coming to an end. Fed members expect US key interest rates to end 2026 just 0.25% lower than their current level.

For 2027, 2028, and beyond, most anticipate stabilisation above 3.0%. The conclusion is therefore clear: we are heading towards a stabilisation of the cost of credit in the United States.

The AI frenzy behind an expensive market

However, 2025 will not have been the most auspicious year for the US stock market. Since the beginning of the year, it has had to settle for a return of around 5% (price and dividends, in euros), far behind many other developed and emerging equity markets.

Buoyed by the tech giants and the craze for artificial intelligence, the US stock market is not exactly cheap. And given the level of investment in AI, it is not particularly generous in terms of dividends.

Some point to the fact that the capitalisation of US markets currently stands at 225% of US GDP (a record high) as proof that share prices are overvalued.

This is a false debate. In the past, General Electric, Ford, and Exxon had significant foreign competitors. Today, American technology giants dominate the planet, or at least the entire Western world. Their scale is therefore completely different.

Nevertheless, to justify such high prices, there needs to be a promising future with good visibility, and investments in artificial intelligence need to pay off.

Inflation controlled despite announcement chaos

For the moment, this is clearly not the case. The incessant White House announcements and constant backtracking have made the business climate particularly uncertain. At the same time, customs duties have helped to keep inflation above target levels.

The economy has therefore had to contend with reduced visibility, combined with still relatively high borrowing costs. And as for whether investors will ever see a return on their investments in artificial intelligence, the question remains unanswered. All these factors fuelled mistrust in 2025, and some of them are likely to persist in 2026.

A real economy that is doing rather well

Investors are therefore ending 2025 in a state of uncertainty, wondering what 2026 will bring. On the macroeconomic front, there is some good news to report.

First, US growth is doing rather well. The GDPNow indicator published by the Atlanta Fed, which attempts to capture current growth, points to 3.5% growth at the end of this year.

In the labour market, job creation is slowing, but the unemployment rate was no higher than 4.4% in September. At the same time, household income grew by 3.8%-3.9% annually throughout 2025, above inflation, indicating that purchasing power is not eroding. Trump's tax cuts will also support purchasing power and corporate profitability.

Add to this the United States' strengths on fundamental issues: a relatively light tax and regulatory framework, a flexible labour market, low energy costs, significant technological advances, all coupled with a clear willingness to defend the country's interests. It is no coincidence that the United States currently accounts for 72% of the MSCI World Index.

Dependency on external financing

Of course, we must not forget that the US economy continues to suffer from serious debt problems. In a decade, US debt has risen from 100% of GDP to around 124% (2024). Given the Americans' low savings rate, the country is increasingly dependent on foreign investors for financing.

This is reflected in bond yields. Despite the fall in key interest rates, the 10-year rate is still hovering around 4.2%.

Faced with high inflation, growing debt, and doubts about the United States' real willingness to clean up its public finances, the widespread decline in the cost of credit may not materialise. However, investors are counting on it to support both demand and investment.

Two major unknowns in 2026

Two events are sure to mark 2026 across the Atlantic: first, Jerome Powell's term as Fed chair will end, and he will be replaced by someone loyal to President Trump.

This succession is bound to worry bond markets: if the Fed chooses to abandon its fight against inflation and throw itself wholeheartedly into a cycle of interest rate cuts to support economic activity at all costs, US bond yields could well rise again.

Whatever the White House decides, the Fed will have to remain faithful to its mandate and continue to implement a responsible monetary policy.

Midterms may challenge Trump’s dominance

The other major event of the year in the US will be the mid-term elections, which will reshape the majorities in the US Congress (the Senate and the House of Representatives).

For now, the Republicans dominate both chambers. But losing a few seats would be enough to change the situation and force the White House to seek compromises with the Democrats.

This would be far from straightforward and could lead to legislative paralysis in the country. Such a scenario would make the second half of Donald Trump's presidency particularly turbulent.

However, it would likely prevent the occupant of the White House from announcing new measures without first consulting Congress. It could therefore be beneficial for the US economy.

An attractive mix for investors

The US economy remains buoyant and continues to enjoy several advantages, including its technological competitiveness and a regulatory framework that is less burdensome and more restrictive.

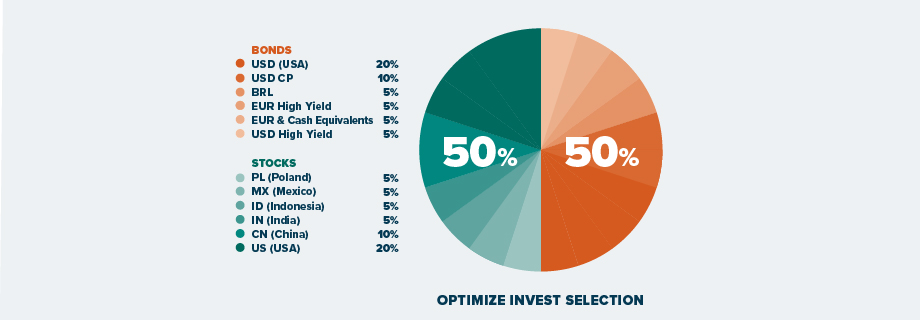

Add to this highly liquid markets and an appetite for risk that attracts companies from around the world. We continue to invest in US financial markets (equities and bonds) across all our diversified portfolios. See our complete asset allocation strategy: