Tensions between Donald Trump and Jerome Powell have escalated, following a criminal investigation targeting the Fed Chair as the White House seeks greater control over monetary policy.

However, robust institutional safeguards remain in place, directly strengthening investor confidence.

A long-standing dispute escalates

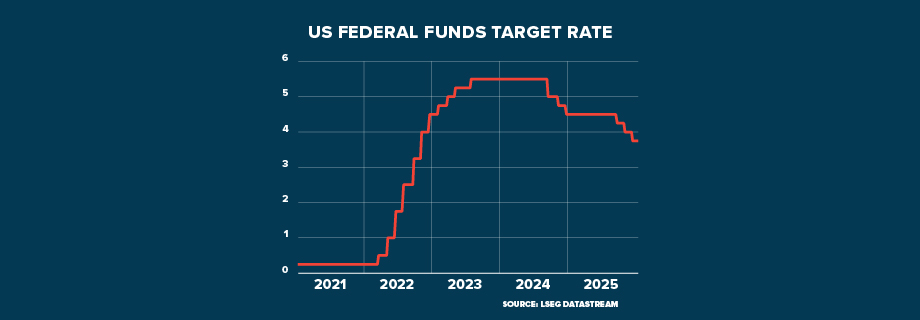

Trump’s 2017 decision to appoint Powell as Chair of the Federal Reserve is now described by the president as the worst of his first term. Trump has repeatedly criticised Powell - whom he mockingly calls “Jerome Too Late” - for cutting policy rates too little and too slowly.

Until recently, this hostility was limited to public insults and unfulfilled threats of dismissal. The Department of Justice's investigation has now taken the conflict to a new level.

The probe centers on Powell’s Congressional testimony about the spiraling costs of renovating the Federal Reserve’s headquarters. Investigators are examining whether Powell misled lawmakers when he said there would be no rooftop gardens, even though plans included landscaped areas.

Few observers are convinced. The investigation is widely seen as politically driven, aimed at forcing Powell out of office.

However, Powell has chosen to respond. After previously remaining silent and emphasising the Fed’s politically independent mandates of price stability and full employment, he has now publicly criticised the actions of the Trump administration.

Controlling the Fed: a recurring objective

This is not the first time Trump has pursued legal action against a Federal Reserve official. Last August, Lisa Cook, a member of the Board of Governors, was dismissed on allegations of mortgage loan fraud. The dismissal was quickly suspended by the courts pending the Supreme Court's ruling. Hearings scheduled for 21 January will determine whether her actions justify removal.

Each Trump administration legal challenge seeks to remove officials resisting aggressive rate cuts and to install supporters of rapid monetary easing.

After a resignation last year, three of the seven Board members now support Trump. Gaining one more seat creates a majority, which explains the pressure on Cook and Powell.

Investors remain broadly calm

If the Fed cuts rates sharply under presidential pressure, US markets could become volatile, and the dollar could weaken. So far, attacks on Powell have not moved markets.

This resilience shows investors doubt a political takeover of US monetary policy could work. The legal case against Powell is clearly weak and unlikely to succeed. Its arbitrary nature also undermines the action against Lisa Cook. Though a final ruling may take months, she will likely keep her position.

Trump’s drive to control the Fed may push Powell to stay on and defend its independence. His Board appointment lasts until 2028, and he is not required to step down when his term as Chair ends in May.

Moreover, Trump’s recent actions have unsettled his party. All Federal Reserve appointees need congressional approval and must show independence to win enough votes. Many lawmakers, including Trump allies, want to prevent the White House from directly controlling monetary policy.

Irreplaceable assets

US assets remain strong because investors see no credible substitutes when hedging against major shocks.

US market turmoil spreads globally. Wall Street crashes affect all exchanges, and global bonds track US rates.

Losing Fed independence could hurt foreign assets, especially in emerging markets sensitive to US financial conditions.

As a result, a well-diversified portfolio continues to allocate a significant share to US assets. For a balanced profile, it is recommended to allocate 15% to US equities and 45% to US dollar-denominated bonds.

Gold and silver: perceived beneficiaries

Although a loss of Fed independence remains highly unlikely, the open conflict between Trump and Powell has unsettled some investors.

To guard against turbulence, investors buy gold and silver, which are insulated from US risk. Both metals hit historical highs this year. Geopolitical tensions, such as those in Venezuela and Iran, contributed.

Despite the sharp rise in gold and especially silver prices over the past twelve months, further gains remain possible amid the economic, financial, and political tensions likely to persist into 2026. Investors can still buy gold and silver.