Both 2025 and 2026 were supposed to be years of renewal for Germany. The end of the obsession with balanced public accounts and the willingness to invest in the future were supposed to enable the economy to take off.

However, neither the economic climate nor the fundamentals are favourable. Ultimately, diversification of Europe's leading economy will be vital. At this stage, only certain individual stocks remain attractive.

Recovery that risks disappointment

The return of the German Conservatives to power, accompanied by an agreement to abandon fiscal austerity that had limited the country's ability to invest in its future, was widely celebrated by financial markets.

The expected influx of capital, both for the country's infrastructure and defence, has given investors confidence. Betting on the revival of the European Union's largest economy, they sent Germany's benchmark index, the DAX, soaring, setting multiple records in 2025.

Of course, the impact of the investment wave is only just beginning. But doubts about Berlin's ability to revive the economy continue to grow.

Firstly, the idea of upgrading Germany's infrastructure is not new. Back in 2019, Angela Merkel and her Finance Minister Olaf Scholz announced more than €40 billion to upgrade the country's infrastructure.

However, a shortage of workers and projects, as well as bureaucracy and the long delays involved in obtaining the necessary authorisations, meant that, in the end, a significant portion of this money was not spent. On the contrary, the country ended the year with a record budget surplus.

Here, the early signs are far from encouraging. Retirement pensions, household benefits and electricity subsidies for businesses are likely to absorb some of the capital needed to prepare for the future. However, their impact on the real economy will be limited and, more seriously, they do nothing to restore the country's lost competitiveness.

Businesses – especially in industry – perceive the environment as unfavourable to investment, with strict regulations, significant environmental constraints, recruitment difficulties and an unfavourable tax system. More than 40% anticipate a reduction in employment by 2026.

And many of them will eventually succumb to the siren calls of the United States or China and move there or elsewhere, to more promising markets where they find the bulk of their customers.

Households are aware of this. They perceive an economy in trouble, declining purchasing power, and employment fears, and are reluctant to spend.

Of course, extraordinary public spending will enable the German economy to do slightly better than the near-stagnation of 2025.

But we are not prepared to go so far as to say that it will revive the German engine. Growth will remain sluggish in 2026 and beyond. While the DAX remains buoyant, the euphoria is waning. There are good reasons for this.

High dependency on exports

There are several reasons why the German economy is suffering more than others in Europe. The fact that industry accounts for a larger share of the economy than elsewhere naturally weighs heavily. Across the Western world, industry is struggling, while the service sector is coping.

Then there is Germany's heavy dependence on exports. In the late 1990s, the country adopted wage moderation to boost competitiveness. This effectively boosted exports, but weighed heavily on household demand, which has never recovered.

As a result, Germany is highly dependent on exports. And since it has focused on the high end of the market, and Europeans' purchasing power has eroded, a growing share of its exports has gone to the United States or China.

A direct competition with the US and China

US tariffs and the development of alternative Chinese products are therefore hitting Germany hard, especially as the country struggles to remain competitive: the disastrous management of the energy transition, with the closure of nuclear power plants and a return to coal, has driven energy prices to soar.

At the same time, faced with an ageing workforce, Germany is struggling to attract and integrate foreign talent.

Last but not least, the profile of German industry overlaps with that of China, as both countries specialise in the same sectors. Chinese competition, therefore, has a particular impact on Germany.

Signals of hope in some companies

Of course, Germany is not just about industry. Here and there, it has developed competitive companies in other sectors, such as Deutsche Post (transport and logistics, purchasing), SAP (technology), and Allianz (insurance).

The country has not yet had its final say, primarily because some industrial companies have managed to remain competitive despite everything. This is the case for Siemens, Siemens Energy and Rheinmetall, which have significantly benefited from the conflict in Ukraine and the German (and European) focus on defence.

A not expensive market in general

But Germany will have to reinvent itself and diversify its economy. And it has a long way to go, having lost some of its competitive advantages in key sectors. In today's highly competitive world and amid numerous challenges, the task will be far from easy.

The German market is not expensive overall. The MSCI Germany is trading at around 15x earnings for the next twelve months, compared with nearly 21x for the MSCI World. On the other hand, some market leaders (such as SAP, Rheinmetall, and Siemens Energy) are trading at what we consider very high valuations. Stay away.

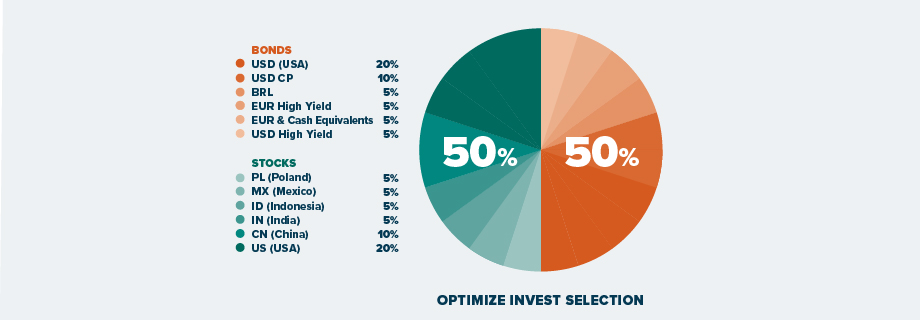

You may also want to consider other opportunities. See our current asset allocation strategy: