Financial markets have had a turbulent month. Doubts about stock valuations, about the capacity of IA investments to come good, the shutdown in the USA, and questions about whether the Federal Reserve will continue to cut interest rates in December have all weighed on investor confidence. At the same time, rising Japanese yields have made carry trades more expensive, reducing liquidity in markets that are already pressured by rising doubts in parts of the credit market.

Emerging markets played a key role

As a result, US markets have changed little over the past month, while EMU markets have fallen back somewhat.

Despite that, our portfolio remained steady. Our large exposure to emerging markets has been good for us, as most of them have had a good month. The outstanding performance of the month comes from two markets: Brazil and Turkey.

Brazil’s comeback

As for Brazil, investor interest has been undergoing a bit of a revival. Initially, relations between Trump and Lula were rocky, and Trump went so far as to impose higher tariffs on Brazil for pursuing what Washington called a witch-hunt against former president Bolsonaro (a fan of Trump’s).

But reality slowly set in. Firstly, given China's restrictions on rare earths, the US softened its tone toward Brazil, which holds vast rare earth reserves and could potentially supply some of the minerals the US needs.

Then, amid rising US inflation, the White House chose to cut tariffs on coffee and meat, two of Brazil’s major agribusiness exports.

Resilience in our portfolio

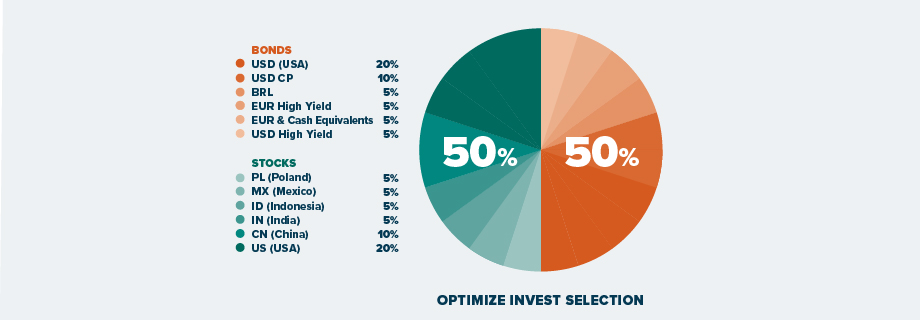

Optimize Invest Selection remained steady this month, as emerging markets provided resilience and offset US dollar pressures. See the fund’s composition below:

While we recognize certain market risks, we continue to identify attractive opportunities in select assets and geographies, maintaining a diversified long-term strategy.