Financial markets have been nervous over the past month. The Federal Reserve cut rates by 0.25% and signaled only one further cut in 2026.

At the same time, several members of the European Central Bank indicated that policy rates are unlikely to move in the near term and that the next adjustment could well be upward. Japan is also considering raising its policy rates in the near future.

Together, this indicates that developed markets are nearing the end of the rate-cut cycle, and rates remain above investor expectations. Longer-term yields have also stayed near pre-easing levels.

Inflation and debt constraints

There are two main reasons for this. First, although inflation is close to policy targets in most regions, it remains a concern. Rising protectionism and its impact on global supply chains have yet to fully play out and continue to worry both investors and policymakers.

Second, global debt levels have risen sharply. The United States budget deficit for 2025 is likely to approach 6% of GDP, and China’s is close to 9%. Japan, despite a government debt of around 230% of GDP, is embarking on another major spending programme. In Europe, countries accustomed to overspending are likely to continue doing so, while Germany is also significantly increasing its expenditure.

As a result, debt is set to continue rising over the short and medium term. Interest rates—particularly at longer maturities—are therefore unlikely to fall, and in the absence of cheap credit, global economic growth could remain subdued.

Fallen angels help to rise yields

Over the past month, yields have risen across most markets, driving bond prices lower. High-yield markets have performed relatively well.

In the US, the credit quality of so-called “fallen angels” (companies downgraded during the pandemic) has improved, with many regaining investment-grade status. At the same time, relatively few companies have fallen into the junk bond category.

Overall, this improvement in credit quality has supported high-yield performance relative to other bond segments in recent months.

China is more dependent on exports

Equity markets were mixed: US and European markets ended flat, while Chinese equities declined on weak domestic demand. Retail sales, investment, and real estate data have been concerning. Meanwhile, exports hit records, increasing China’s reliance on foreign trade, even as US exports decline. A new monetary, fiscal, and budgetary stimulus is expected; China's potential remains intact.

Turkey fundamentals are promising

Turkey was the standout performer this month. Lower inflation and a gradual reduction in interest rates have reassured investors, who believe the country is slowly improving. While much could still go wrong, fundamentals are showing signs of recovery and, barring unorthodox decisions by President Erdogan, 2026 could be a positive year.

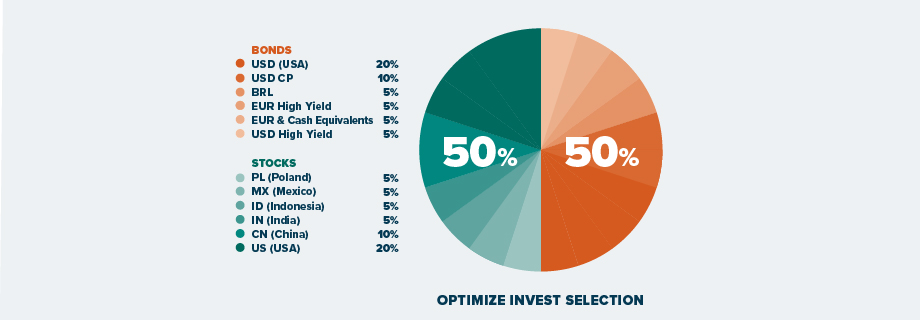

Overall, the Optimize Invest Selection ended the month broadly unchanged and closed the year with a gain of 1.6%.

In 2026, AI-driven capital spending, fiscal pressure, and policy divergence will shape growth, while political risks and labor market weakness in some regions remain key concerns.

Nonetheless, value persists in certain assets and geographies. A diversified, long-term strategy remains appropriate.