Financial markets have enjoyed a good month. Lower discount rates in the US (and the promise of further cuts to come) have fueled strong performances, particularly in Emerging markets (India, +4.4 %; Indonesia, +4%) and those with a significant tech presence.

Most other markets also performed well (the S&P 500, for instance, advanced 2.3%), and solid gains have been the rule over the past few weeks. Even a shutdown lasting 3 weeks in the USA (now more than 40 days) and the ongoing political crisis in France have failed to curb investor enthusiasm.

Bankruptcy impacted high-yields

Naturally, the prospect of lower interest rates was also good news for bond markets. Lower yields were the flavour of the month, and bond indices rose in most regions.

The one major exception has been in the high-yield universe, where yields have been on the rise, both in the USA and Europe, given, among others, the bankruptcy of the First Brands Group, a major US auto-parts supplier, as well as the fact that a rise has also hit several US regional banks in bad or fraudulent loans.

Taken together, these factors could ultimately lead to a tightening of financing standards. That would in turn restrict access to credit, particularly in the high-yield space.

Uncertainty still permeates Europe

Things have been relatively quiet on the currency front. However, the weakening of the euro versus the USD is worth noting.

There are several reasons for this: France's financial struggles are concerning investors. The economic outlook for the Eurozone remains uncertain. And finally, monetary policy appears somewhat at a loss, with the ECB still unsure about its next step.

Gains for our suggested portfolio

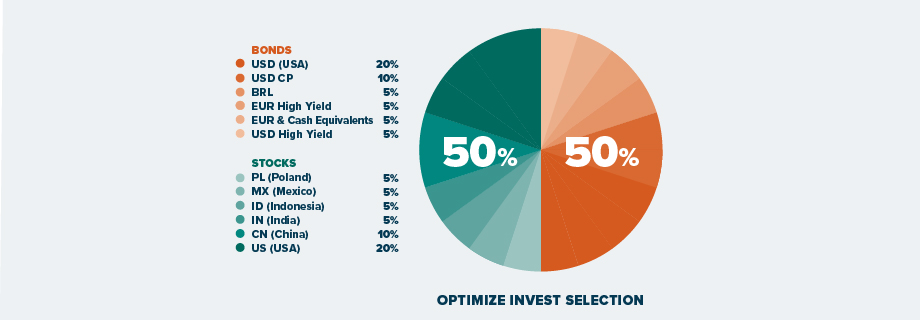

Overall, the Optimize Invest Selection gained 2,7% in the last month and continues to perform quite well this year.

We are comfortable with the asset mix of the portfolio, and we will continue to seek opportunities to maintain the sound momentum while keeping risk under control. See our asset allocation strategy below: