With a GDP growth rate of 5.04% in the third quarter, following 5.12% in the previous three months, the Indonesian economy remains dynamic. This economic momentum is also based on solid foundations. Household consumption, which accounts for more than half of GDP, grew by 4.89%. Business investment remains strong (+5.04%). Public spending is under control (+5.49%) and exports continue to rise sharply (+9.91%).

Increase in exports despite tariffs

The boom in foreign sales, including to the United States, which plays a key role in the country's economic development, was the pleasant surprise of the third quarter. This indicates that Indonesian producers remain competitive despite the introduction of a 19% US customs duty in August.

Such a rise in Indonesian exports comes despite the poor performance of the mining sector, which has been hit by slowing global demand for coal, a decline in copper production and a catastrophic mudslide in September that killed seven people and shut down one of the world's largest mines.

Expected GDP growth is around 5%

The Indonesian economy remained robust in the third quarter and is expected to continue this trend in the final months of the year, thanks to the implementation of a multi-billion-dollar stimulus package. The cut in the key interest rate to 4.75% from 6.25% just over a year ago will also support economic activity in the coming quarters.

With a large domestic market of 280 million inhabitants, sought-after natural resources, and an ideal location in Asia, the world's most dynamic region, Indonesia is expected to continue posting GDP growth of around 5% in the coming years.

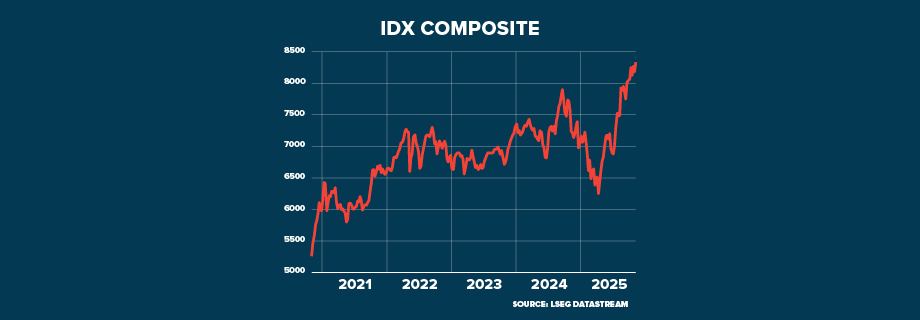

These positive economic prospects justify investing in this emerging country, which also offers reassuring financial stability. Buy Indonesian shares and see our complete asset allocation strategy.