After several weeks of delay, the US labour market figures for September have finally been released: the unemployment rate rose slightly to 4.4%, compared to 4.3% in August.

While they were somewhat reassuring, investors preferred to focus on job creation. On this front, the figures are good. Some fifty-three thousand new jobs were expected. About 119000 have been created.

At the same time, hours worked have remained stable, workers' incomes continue to grow faster than inflation (+3.8%), and the participation rate is rising to 62.4%, a sign that more and more Americans are participating in the labour market and therefore earning income.

Fewer chances of rate cuts

Investors did not receive these figures well. For several weeks now, they have been worried about the tone of members of the US Federal Reserve, most of whom are sceptical of cutting key rates further in December.

The minutes of the last monetary policy meeting confirmed their caution. From more than 90% a few weeks ago, the chances of a cut in key rates on December 10 have fallen to 50%, and those who voted in favour highlighted the weakness of the labour market.

However, this report, published several weeks late, raises doubts about this scenario and does not show any particular weakness on this front. As a result, the chances of a further decline have diminished further, and the prospect of cheaper credit, which could boost consumption, is receding.

Why investors disliked this scenario

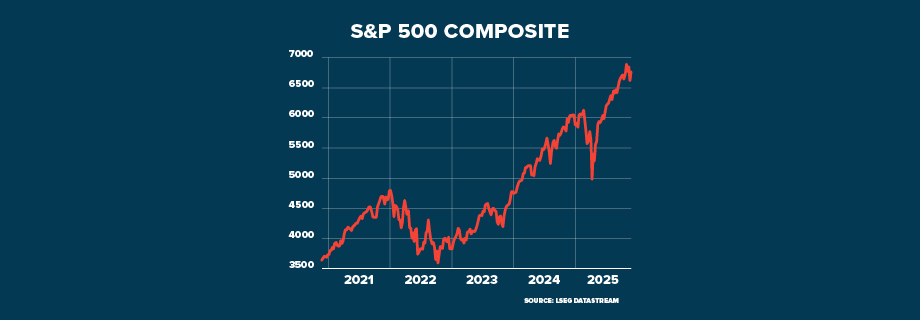

At a time when investors are hesitant amid high prices in US markets and doubts about artificial intelligence's ability to generate profits, this news was poorly received by markets, causing the most considerable turbulence since April.

In the face of current turbulence, we advise you to stay invested but to diversify your assets appropriately. See our suggested asset portfolio allocation strategy.